Smart Money Moves for a Brighter Tomorrow

Expert guidance and tailored solutions for your financial journey. Access a wealth of resources to help you make informed decisions. Start achieving your financial goals with confidence today.

The Urgent Need for a Shift in Society’s Perception on Financial Health

In an era where personal finance has become a minefield of options—cryptocurrencies, meme stocks, and the constant buzz of ‘buy now, pay later’—it’s timely to question our fundamental approach to financial well-being. The notion that money management is a personal and often private matter has been perpetuated by a society that shies away from discussing its pitfalls openly. But the financial landscape is changing, and the tools, as well as the stakes, have never been higher.

Navigating the World of Investment: Strategies for Financial Growth

In navigating the world of investment, it’s crucial to understand various strategies aimed at achieving financial growth. One such strategy involves diversifying your investment portfolio across different asset classes to mitigate risk and maximize returns. Additionally, staying informed about market trends, conducting thorough research, and seeking professional guidance can help investors make informed decisions and navigate the complexities of the investment landscape effectively.

LATEST NEWS

FREQUENTLY ASK QUESTION

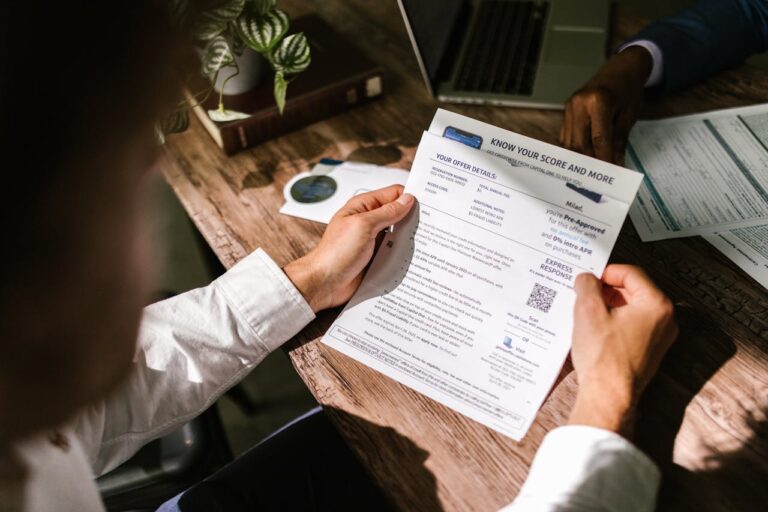

The upside to these credit cards is that you do not need a credit history in most cases to apply and get accepted, however approval is not guaranteed. Most secured credit card offers request a relatively low deposit to get started and some even offer rewards. The downside is that they can have relatively high interest rates, most have an annual fee you have to pay, and in some cases a processing fee as well. If one of your goals is to build your credit be sure the issuer reports your transactions to the three major credit bureaus. It’s important to start building up your credit as it can affect the types of loan terms you can get, the insurance you will pay, and the type of apartment you can rent or car you can buy. In some cases it may even translate to the job you can get. These credit cards can be a stepping stone on your journey to building your credit, but remember, it is up to you to manage your credit responsibly.

If you are starting to build your credit, there are both secured and unsecured credit cards that may be an option for you. With responsible credit management by you, you can start building up your credit history to move on to better offers. This is a solid starting point if you are a first time credit card owner and you find yourself looking to build your credit.

Credit cards offer various benefits, including convenience, rewards programs (such as cashback, points, or miles), purchase protection, travel insurance, and the ability to build credit history.

APR stands for Annual Percentage Rate, which represents the cost of borrowing on a credit card expressed as a yearly interest rate. It includes interest as well as certain fees associated with the card.