5 Must-Know Credit Card Tips for Financial Beginners

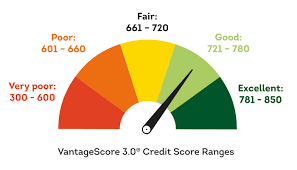

5 Must-Know Credit Card Tips for Financial Beginners Navigating the world of credit can be as daunting as it is essential. Credit cards are versatile tools that, when used wisely, can unlock a world of convenience and even benefits like cashback and travel points. However, their misuse can lead to a spiral of debt and credit score damage that lasts for years. For financial beginners, understanding the do’s and don’ts of credit card usage is crucial. Here are five vital tips to keep in mind as you emerge into the credit realm. 1. The Exquisite Art of Building Credit Understanding credit is akin to trying to decipher a complex puzzle; where every piece (your on-time payments, credit utilization, types of credit, and the length of your credit history) is essential. Make it a habit to pay off your full credit card balance each month—it’s the golden rule of credit. Doing so not only protects you from racking up interest charges but also incrementally establishes a positive credit history. If the occasional month becomes a battle to pay the minimum due, it’s a sign your credit card spending has outstripped your income – steer back on course immediately. Your credit is your financial fingerprint. Start building it thoughtfully, and over time, you’ll see opportunities open, from lower interest rates to better investment prospects. It’s a silent testimony to your financial trustworthiness – make sure it’s a story you’re proud to tell. 2. Fine Print, Big Decisions When you’re handed your first credit card, it’s tempting to leap before you look. But restraint and thoroughness are your best friends in this scenario. Those dense contracts and seemingly endless terms and conditions aren’t just lawyer-inspired fluff – they’re the fine print that dictates your card usage and the rights and responsibilities that come with it. Take the time to read through them; it’s an investment in your financial literacy. Look out for interest rates, annual fees, and any introductory offers that may end abruptly, leaving you with unexpected costs. Understand what each fee means in practical terms for your finances, and never be afraid to ask for clarifications. Remember, as a consumer, knowledge is your greatest leverage in making informed financial decisions. 3. Rewards—A Perk or a Temptation? Credit card rewards programs are a tantalizing prospect. The promise of cashback, points for every dollar spent, or travel perks lures in many a cardholder. But here’s where the business adage of ‘nothing comes for free’ is most pertinent. To make the most of rewards without going overboard, stick to a budget and ask yourself whether your purchases are truly necessary or if they’re driven by the reward chase. Select a reward program that aligns with your spending habits or future aspirations. For instance, if you’re a frequent traveler, a card that offers air miles might be more beneficial than one offering grocery store discounts. Rewards should be just that—a compliment to your practical spending, not the driving force behind it. If used wisely, they can offer delightful bonuses. If not, they’re just another pitfall in the credit card playground. 4. The Surprising Impact of Your Credit Utilization Credit utilization is one of the most underrated yet significant factors in your credit score saga. It’s the ratio of your current credit card balances to your available credit and demonstrates to lenders how responsibly you manage credit. A good rule of thumb is to keep your credit utilization below 30%. However, the lower, the better. High credit utilization can signal financial distress—even if that’s not the case. Make smaller, regular payments throughout the month if necessary to keep your utilization in check. Ponder over your credit card limits. While it might feel empowering to have a high limit, it can also be a double-edged sword. A lower limit is often a safer cushion against overspending. Adjust your limit to a figure that encourages responsible usage, not reckless abandon. 5. The Crucial Dance of Adding and Managing Credit Card Subscriptions Every swipe powers up your purchasing potential—but this is a Marvel movie without the superhero supervision. When a new card appears in your wallet, treat it with as much caution as excitement. New cards mean new credit lines and, potentially, new debts. Approach new credit card applications with careful consideration. Each application triggers a “hard inquiry,” which can dent your credit score. Aim to space out your applications to protect your score and prevent any red flags with future lenders. Strategize your credit card portfolio like an investment. Consider the benefits of different cards and their costs, and don’t be afraid to return or reassess them as your financial needs evolve. Remember, multiple cards don’t always guarantee a higher score or greater purchasing power. It’s the management of these resources that’ll make or break your credit trajectory. Make every move purposeful and well-considered. Entering the credit card world is like being handed a powerful artifact; use it wrongly, and it can lead to your undoing. Use it astutely, and it becomes a tool that empowers you to meet life’s financial necessities and luxuries with equanimity. These tips offer a grounded approach to harnessing the goodwill of credit, helping you to build a sturdy platform for your financial future.